The world today is an ever-changing landscape, with new technologies and safety measures being developed every day. One of the most important areas of safety and security is the banking sector, which holds some of the world’s most important and valuable assets. But how do banks ensure that only authorized individuals have access to these boxes? The answer lies in access control automation through PAS Secure Self Storage solutions. The PAS solution is a self storage product that modernizes safe deposit box functions by integrating self-service biometric access, customer management, and event logging complete with notifications into existing legacy safe deposit box operations. It allows organizations to centrally manage, secure, and control access of the user storage.

- Biometric authentication that verifies users for secure room entry

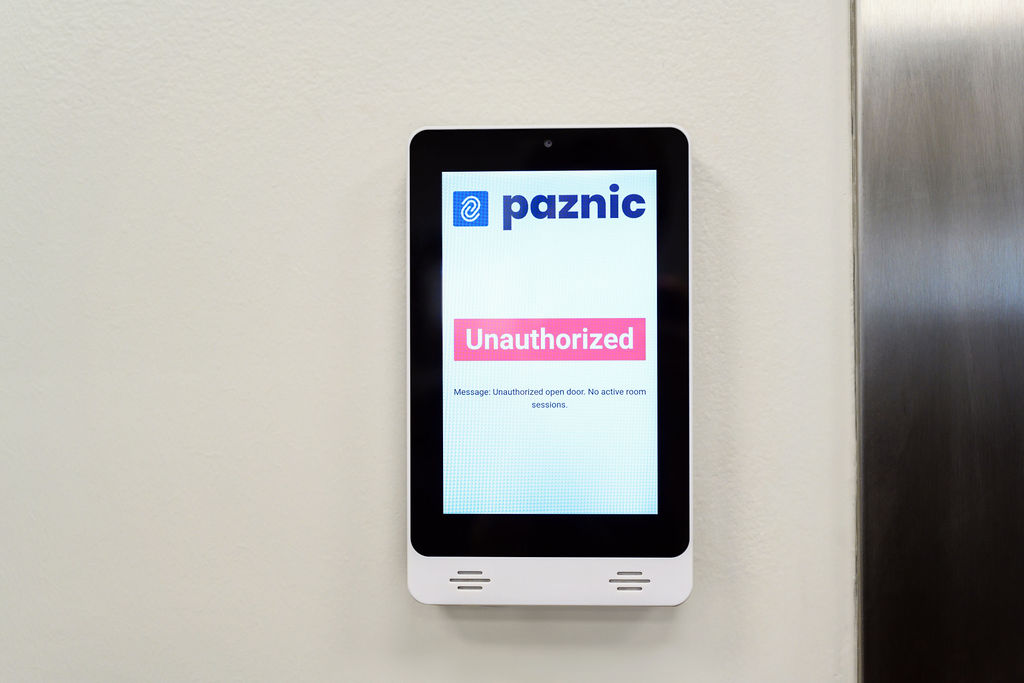

- Control door access and proactively monitor room sessions

- Individual box monitoring using encrypted wireless technology

- In partnership with trusted hardware solutions

- Complete cloud-based application for total user management for customers, employees, and businesses

- Direct customer registration and oversight at the local and national level

- Register employee accounts with multiple permission levels across organization

- Event logs for all room and box access

- Report generation by site, date range, customer, event, or custom search

- Unauthorized access alarms & push notifications

- Proactive self-monitoring for system errors

- Email notifications for alarms

- Manage multiple sites within your organization

- Dashboards for monitoring site status, box usage, and total box availability across all sites

- Manage customer and employee accounts across all locations

- Utilizing Microsoft Azure for hosting the registration & management interface

- Entire system operates on our independent stand-alone PAS network

- Secure cloud storage of customer data with Azure SQL database

- Secure communication between sites and cloud application utilizing TLS 1.2

- Building trust by protecting customer data

- Supporting customer compliance needs

- Keeping data secure and reducing risks

- Standing out with a strong security focus

- Simplifying client approval processes